|

The Devaluing of CurrencyIf You Believe Things Cost More Than They Did, You Overlook What's Truly Happening...an Intentional, Calculated and Manipulated Devaluing of Fiat Currency via Inflation Tax Although most everyone has heard and is aware of words such as inflation, deflation, etc., MOST have no idea what they "truly mean" or what causes them. A LOT of people "think they know" although few REALLY know. One example of how "true" that is, can be realized when the words "inflation tax" are mentioned. When you mention "inflation" to most, it's perceived as being "higher prices." Higher prices is an illusion masked by the real problem. The Real Problem that enables INFLATION to happen is a devalued currency.

What's ironic and very troubling is that for many years, MOST have remained "UNAWARE" that a "problem" exists and equally "UNAWARE" that for any "perceived problem", whether realized or not, a solution also exists. Inflation tax is a HUGE problem for MOST. But, unbeknownst to MOST, it's a workable problem that has a long term and potentially transformational solution. First, it's necessary to recognize and understand that there IS a problem. You must also become "aware" and understand what the problem is before you can implement a solution. I'll share all the FACTS and details about both the problem and the "solution" very soon. Once I've shown you all the troubling, unsettling and the very liberating FACTS that follow, I'm going to provide you with the VERY solution that I discovered after making the choice to become INFORMED and AWARE of what had taken place. It's the very solution that I and my entire team uses and has used for quite some time. It's a solution that EVERYONE on this planet needs, is looking for and has access to, yet MOST are simply UNAWARE that such a thing exists. It DOES exist and it HAS existed for centuries. What's better than that is, ANYONE can do it. What's "kind of ironic" is the fact that the "problem" for which this "solution" became necessary, (and which alleviates the problem WITHOUT FAIL) isn't widely known or understood. As far as WHY most aren't aware of it... EVERY Money Problem stems from an "under the radar" problem that's "intentionally" being masked and kept from the "unaware" on purpose.Most EVERYBODY, realizes there's a "problem" in our Global Monetary System, yet they're unaware of THE ROOT CAUSE of the "problem", have ZERO understanding about how it came to be a problem in the first place and/or why it "exists" at all. Fiat Currency aka "Paper Money" is the Real ProblemThe problem that creates inflation and recession is the currency we use. A LOT of people confuse the word “currency” with money. Currency isn’t money it all. It’s paper. That’s ALL it is. More than that, the currency we utilize currently is called “money”, yet in reality it’s nothing more than WORTHLESS paper with ZERO "real value." Although MOST believe that "paper money has value", that's precisely what keeps all the "money problems" that so many are experiencing alive. Ironically, the VERY system that's "creating the Problem" and keeps the SYSTEM alive is the very THING that is KILLING and DIMINISHING the VALUE of the money we use. It's also what keeps citizens of the world "seemingly trapped" in a state of struggle, BONDAGE and SLAVERY without realizing they are. To break the cycle and free yourself from this "under the radar" form of BONDAGE and SLAVERY that Inflation Tax creates, it's of VITAL importance to understand what has happened and WHY. That's PRECISELY why our founding Fathers created a LAW to guard from such NONSENSE...  The sad truth for MANY is, it's going to get FAR worse before it gets better, for those who remain "unaware, UNPREPARED, oblivious and/or "unwilling" to take action. I'm going to provide you with some FACTS and a "plan of action" that will not only prepare and protect you from any "potential money crash" that it “seems as if” is very close. It will enable you to create Real, Lasting and Sustainable Wealth REGARDLESS of what our "current financial system" might do. Once I've shown you the FACTS, I'm going to show you the solution AND how to open a FREE account so the "money problems" that most are having, without realizing what it is, won't have to REMAIN caught up in the problem" for long. Depending on a few factors that are yet to be determined as it pertains to you, I'll be providing you and a "select group" with the opportunity to look over my shoulder so those who we'll be working closely with can observe, learn, SEE and EXPERIENCE for themselves just how exciting, SIMPLE and FAST creating Real, Lasting and Sustainable Wealth can be. It's a Real form of wealth that isn't subject to the adverse effects of recession, inflation, deflation or the current economic crisis that's underway which is causing so many "money problems." For Now...Back to the FACTS Regarding Money Problems as Disheartening and Troubling as They May SeemAs you move through what follows, do your best to keep in mind that I don't share the following FACTS with the intention of scaring or alarming you, but rather to EDUCATE, Empower and assist you in becoming "aware of" and able to clearly SEE what's happening with and IN our GLOBAL monetary system. I’ll warn you up front, on the surface, it’s UGLY. REALLY ugly. Once you're aware of it and SEE it, you'll have the choice to fix it. You’ll also have the choice to ignore it. I hope you won’t "choose the latter" for your own sake. Although I'll be providing the FREE solution, I can't do it for you. That part will be up to you.

We're not talking about "paper money" here. The solution has absolutely NOTHING to do with paper money with the exception of learning what "paper money" truly is and once understood, “exchanging it” for Real Money. We're talking about doing something that has provided, does provide and will continue providing Real, Lasting and Sustainable Material and Monetary Security far into the future. More about that soon. It doesn't matter where on the planet you live. If you have a monetary system that uses the U.S. dollar as it's gauge for the value of it's "currency, (most every country on the planet does) there are some "unsettling, disturbing and SCARY things" happening with the U.S. dollar and the monetary system we use, that MOST are oblivious to. The FACT is, it's been happening for many years. The repercussions from WHAT has been happening have escalated to such a degree that the ENTIRE world's financial systems are being adversely impacted. When the entire world's financial systems are impacted, YOU are impacted. The most recent reason why, is the 2008 mortgage crisis. It nearly crashed the ENTIRE planet's monetary system. It was a financial crisis created out of greed, lies, deceit and downright illegality. Because of who was involved though, no one got arrested. A LOT of people should have been, but nobody was. Instead the perpetrators not only got away clean, they got “bailed out with BILLIONS upon BILLIONS of dollars of YOUR money.

Then, top management received HUGE bonuses for creating the VERY mess that almost toppled the entire world’s financial system!! That is beyond crazy to me. But again, because of who they are, they got away clean, with a WHOLE bunch of bonus money. The impact it's STILL having, pertains to you individually just as it does to the other 7 BILLION plus people who exist in the world. In other words, it's a "HUGE problem" with potentially devastating consequences for A LOT of people...YOU included.Just ONE of those things that impacts us ALL is "recession." We hear about "recessions" all the time. We tighten our belts and sacrifice during recessions. Yet FEW KNOW how or why recessions happen. We won't go into that here in depth except to say that the "root cause" of recession is inflation. We hear that word A LOT too. ESPECIALLY in today's world. Although inflation is the cause of recession there's a "deeper problem" that both recessions and inflation stem from. The Root Cause of Inflation, Deflation and Recession is an Underhanded, Scandalous, Corrupt, Out of Control and Unconstitutional Monetary System Put in Place in 1913 that is Teetering on the Brink of Collapse

Those are some strong words. But they're more than words, they're FACTS. I share them so you might decide whether it's YOUR time to take a few very simple, yet VITALLY IMPORTANT STEPS that MUST BE TAKEN, if you ever hope to thrive (or at the very least, get and stay ahead) in today's teetering, turbulent and topsy turvy GLOBAL financial environment. Rest Easy, There's Great News Coming Once I Reveal |

One of these...

|

...could be |

10 of these |

In today's economy, the same Federal Reserve Note that could be exchanged for 10 loaves of bread, only has enough "exchange value" to trade it for approx 1/3 of a loaf.

It's not limited to bread. Over the past 40 years alone, the increase in the number of Federal Reserve Notes required to exchange for groceries in general has increased anywhere from 150% to 1,100%.

So what happened to the price of bread and groceries?

We'll...nothing really. But SOMETHING definitely did change. We'll get to and pinpoint exactly what that change was as well as HOW and WHY things changed so dramatically in just a minute.

First let's fast forward from 1937 to 1962 and see what took place 25 years later.and look at the ENORMOUS changes in the exchange value of Federal Reserve Notes since between 1937 and 1962.

If you think the cost of groceries was a BIG change and you find it unsettling, you might want to sit down and prepare yourself for the next FACT.

Let's fast forward from 1937 to 1962 and look at the what the manufacturers suggested retail price of a new 1962 Chevy Impala SS was in 1962, vs the current MSRP of a 2014 Impala 2LTZ.

New 1962 Chevy Impala SSList Price - $3,465.00

|

New 2014 Chevy Impala 2LTZList Price - $41,590.00

|

On the surface, it "seems as if" the 2014 Impala 2LTZ is A LOT more expensive.

Sure, today's Impala 2LTZ has many neat new gadgets and some amazing technologies have been created and added to automobiles since 1962. No doubt that cars have more frills and more technology than they did, but do you honestly believe that a price increase of 1,200% was necessary to own the same Model of vehicle that could be acquired in 1962?

Does that really make sense? I mean REALLY? Think about it.

In 1913 the cost for the 1962 Impala would have been $1,135.88. That's a 67.2% inflation rate.

In comparison, in 1913 dollars, the 2104 Impala would have cost $1,730.73 equating to an "inflation rate" of 95.8%.

In the last 10 years alone, what WAS $100.00 in 2004 only has an "exchange rate" of $79.40 today resulting in a 20.6% "inflation rate" in that short 10 year time frame.

NOT enough to justify a

The answer is NOTHING happened to the "price" of bread, groceries, cars, homes, or ANYTHING else for that matter.

What REALLY happened (and continues to happen) is a DEVALUED currency...aka INFLATION TAX.

The definition of DEVALUATION according to Merriam Webster Dictionary is...

1: an official reduction in the exchange value of a currency by a lowering of its gold equivalency or its value relative to another currency

2: a lessening especially of status or stature

The paper money (Federal Reserve Notes or WHATEVER you countries "paper fiat currency" might be called) have DECLINED in value making it necessary to exchange, at BEST, 24.03 of the same 1 dollar Federal Reserve Notes in 2014 to receive the same exchange value for the goods and services they could be exchanged for in 1913.

That's a 2,403% Increase in the number of Federal Reserve Notes needed to trade for the SAME amount of goods and services!!

To receive the same value as was received in 1937, 16.52 of the VERY SAME Federal Reserve Notes in 2014 for what 1 single Federal Reserve Note COULD BE exchanged for in 1937.

In the last 75 years ALONE, the "COST" incurred by every individual GLOBALLY who depends on and exchanges "paper currency" for goods and services is HUGE.

The consistent and long term erosion and devaluing of our currency has resulted in a 1200% PLUS increase in the number of paper dollars required to exchange for the SAME, or similar goods and services that COULD be and were acquired in 1937 with FAR FEWER Federal Reserve Notes.

That's the price we've paid for depending on, using and continuing to allow a fiat currency to exist as our "medium of exchange", namely Federal Reserve Notes aka "paper money"

Put simply, in 2014 it requires approx. 12 of your $1.00 Federal Reserve Notes just to match the "value" and purchasing power that the SAME $1 Federal Reserve Note held in 1937!!!

The U.S. dollar itself has little difference cosmetically. Same paper, same ink, same printing presses, same process to print them.

Although very little if anything about the dollar itself has changed, the EXCHANGE VALUE of today's dollar HAS changed. It's Exchange Value is DRAMATICALLY different...almost non-existent in fact. Worse, it seems as if the little "exchange value" the current Federal Reserve Note has left is becoming (and in the not so distant future, very well may become) extinct should it lose the little "value" it has left.

So what happened to the Real Value of the dollar?

A "Promise to Pay" is the ONLY Thing That Gives "Paper Money" ANY Value

The FACT that it's necessary to exchange far greater amounts of "paper fiat currency" today to acquire the same quality and quantity of goods, products and services that lesser amounts could be exchanged for in the past, has led to a LOT of confusion and a HUGE MISUNDERSTANDING...a COSTLY misunderstanding that equates to a form of slavery.

The Confusion and Misunderstanding Stems from MANY (Most Actually) Believing That, EVERYTHING is More Expensive Today than It Was in 1913, 1937 or 1962

Let's clear up the confusion and ANY misunderstanding about "things" being ANY more expensive today than they were in years passed...

Things are NOT any more "expensive" today than they were in 1913. Yes, it takes MANY MORE Federal Reserve Notes to exchange for things than in years passed. But, if you hold and were to USE a very secure and sound Real Money, that has had, does have and will continue to have "Real Intrinsic Value" as your "medium of exchange", you'd SEE that NOTHING is ANY more "expensive" than it once was.

In 2014 the

|

...still holds enough (or more) "purchasing power" needed to exchange it for and acquire... |

...this, this, this and THIS...just as it did in 1913

|

Unlike GOLD and silver, both of which have a 5000 year history of retaining some form of Real Value, Federal Reserve Notes (paper money) have no "intrinsic value" whatsoever. They are created out of "thin air" and have ZERO backing with the exception of a "promise to pay."

That's what the word "Note" in Federal Reserve Note means in "legal jargon"...a promise to pay.

Our "belief in" that promise is THE ONLY thing that gives the "paper currency" that's in circulation today, ANY value at all.

Based on the long history of "broken promises" by governments, it's not very "wise" to depend on a "promise" alone to ensure your livelihood.

Gold doesn't require depending on a "promise" because it has "intrinsic value" just as it did 75 years ago. The promise of the "value" of GOLD is in it's history.

A Promise Can Be Broken but the "Exchange Value" of a Hard Currency Such as GOLD, Has Held and Continues to Hold it's VALUE...Regardless

The government that operates in whatever country you reside in "makes the promise" to back the money in that country. In COUNTLESS cases throughout history, when the "financial vehicle" utilized by ANY country or civilization is a "fiat currency", that promise to pay ENDS at some point.

Put simply, throughout history, in 100% of the cases, when a fiat currency was utilized as a medium of exchange, the monetary system crashed and burned

The "average life span" of a fiat currency system is 42 years.

But the system they use (a private corporation made up of ELITE Bankers, called The Federal Reserve) which HAS enabled, DOES enable and will continue to enable juggling and manipulation of the entire GLOBAL monetary system making it "seem as if" (and to a degree "look as if") they're keeping their "promise to pay."

For MANY years that "promise" has been kept in a sense. You can still trade the "paper currency" you earn for goods and services. But in another sense that same "promise" has diminished DRAMATICALLY.

The appearance that the "original promise" is being "kept" has only been (and remains possible today) because the government "allows" the entire globes monetary system to be manipulated, the DEVALUATION of currency continues as the Federal Reserve continues "printing more PAPER dollars."

There's a BIG Problem that stems from that

When you print MORE of something that is "supposed to be money", yet it has NO intrinsic value whatsoever, the more of it you print and the more "notes" that are created and released for circulation, the less VALUE they have and more DEVALUED those notes become.

It's a VERY simple equation of "Supply and Demand." Increase the supply and the "perceived value" often referred to as "cost" comes down.

That can be a great thing when you're on the buying end. But when you're on the value receiving end, it's anything but great.

The citizens of the world (you and I included) aren't "receiving" anything good, let alone great under our current financial structure. What we ARE receiving is less "exchange value" for the same labor AND a dramatically diminished value when we "exchange" the paper currency we receive for the work we do (which has VERY LITTLE value) for the goods and services we need.

Manipulating and DEVALUING an already DEVALUED "note" further, can (and currently does) result in a "promise to pay" seeming as if it's being carried out. The promise is being kept to a degree in one sense, yet in another it's a quickly "dwindling and diminishing promise" as the VALUE of the dollar continues to dwindle and diminish in VALUE.

A "promise to pay" can't be kept by ANY government regardless of how things "seem" when the "thing" they're using as an "exchange of value" and promising to pay on, reaches the point where it has ZERO value.

As the "exchange value" of the Federal Reserve Note (FRN) diminishes further, we still do the same amount of work for the notes we receive. But because of the "diminishing value" of those notes, we receive less value for the notes we receive and exchange, although the work we do to earn it remains the same or intensifies.

It's much like "slave labor."

Intense work is ALWAYS going to be a part of the future of those who continue to "work" and continue to accept and receive a "fiat currency" with diminishing value and FAR less purchasing power than it previously held.

Same amount of work yet less reward and compensation for the SAME work = SERVITUDE.

It doesn't matter what the numbers on your check SAY. What DOES matter is the "Exchange Value" of the paper dollars that those numbers imply that you're receiving.

They can be deceptive and billions of "unaware" people GLOBALLY ARE being "deceived."

What's more, if we continue to depend solely on the consistently declining exchange value of the "paper currency" we receive and exchange for the goods and services we purchase, the amount of goods and services "exchanged for" must be diminished as well.

When the "value" diminishes, what we receive in the way of value diminishes.

That is why Federal Reserve Notes look the same and in FACT ARE the same since the Federal Reserve took "control" of the money supply in 1913. Although they "appear as being the same", they have LOST 98% of their ORIGINAL Value, resulting in a 98% reduction in Purchasing Power since 1913.

Although MOST people think that goods and services purchased today cost more than they did in 1937, they don't. Granted, it "seems as if" things are more expensive...especially when you make the really BIG purchases like homes and cars.

They're NOT any more expensive but it DOES take MANY MORE Federal Reserve Notes to exchange for them than in the past.

In the case of cars and houses...A LOT more.

Let's take a REALLY close look at what's REALLY happened...

The graph below shows the rate of DECLINE of the "value" of the dollar between 1913 and 2007. As you can see, it's a HUGE decline.

While it's true that MOST people think prices for groceries, cars, homes, etc. have gone up, in MOST cases prices haven't gone up at all. The VALUE of the paper dollar that we "exchange for" these goods and services has DECLINED by 98%.

SAME Dollar with FAR LESS "exchange value"...a whopping 98% DECREASE in Value in fact since 1913?

The VERY SAME Dollar that you and I exchange our value for and then use to feed, clothe and house our families, and it NOW has 98% LESS buying power than it did when "the promise to pay" was first made.

Initially that "promise" was made when the "paper dollars" received were backed by a commodity with "intrinsic value."

The commodity that was once used to KEEP the value of our currency in check was gold and silver.

So WHAT Happened?

|

For the sake of time and brevity, we won't cover ALL of the FACTS regarding how our current monetary system came into existence or how it all works here in this article. But I will say due to the way it ISN'T working, finding an "alternative" would be a wise choice.

The bottom line is this...

In 2014, this...

|

...currently holds an "exchange value" of... |

...this much

|

The SAME Federal Reserve Note that COULD be (and was) exchanged for a FULL $1.00's worth of goods and services in 1913 has only retained .02 cents worth of it's original value and "buying power".

You CAN learn how to opt out of, and stop "allowing" the DEVALUING of your paper dollars via "Inflation TAX" to adversely impact your finances and the quality of your life.

What's better is that you can do it ALL for FREE

In the articles that follow, I'm going to provide an "uncommon form of education" that shows you how you can take 3 VERY simple and Financially Liberating steps that will protect and Grow Your Personal Wealth exponentially…

|

That alternative was introduced and ingeniously created by Karatbars International founder Harold Seiz.

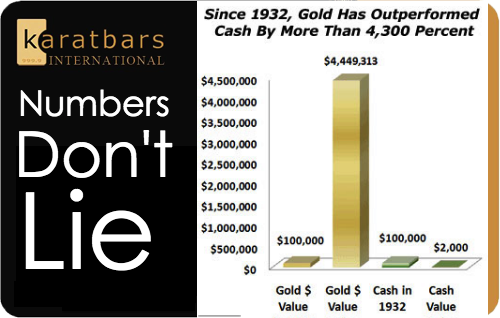

Here are the FACTS pertaining to a DEVALUED paper fiat currency that keeps so many unknowingly enslaved and bound and a REAL and stable form of Real Currency that liberates and sets FREE...unlike governments...Numbers don’t lie!

$100,000 cash (fiat currency) in 1932 is now valued at $2,000

$100,000 gold in 1932 is now valued at $4.449 MILLION!

|

What follows will not only enable you to BECOME aware, the solution I'll be introducing you to and providing to you ABSOLUTELY FREE, is very easy to take advantage of and the doing is equally simple.

Everyone has access to this solution and ANYONE who chooses to make the move can make the shift from consistently experiencing "money problems" to receiving to an abundance of money, DAY after DAY, WEEK after WEEK and Month after month, FAR into the future.

What's better, is that the "solution" I'll be introducing you to, is 100% EFFECTIVE 100% of the time for those who USE it AND it's absolutely and 100% FREE.

No strings, no fluff, no hype, no nonsense. A FREE solution to an ENORMOUS and growing "problem" that EVERYONE on this planet is being impacted and affected by and NEEDS a solution for.

We show you an ingenious way to convert your paper money to GOLD, secure and even "grow" the "value" of your "paper dollars" and prosper in the process with Karatbars International.

How so?

The Karatbar - An alternative to "Paper money" available in quantities that EVERYONE can afford.

The 999.9% GOLD Karatbar provides a safe, secure, recession proof alternative to DEVALUED "paper money" and has REAL Intrinsic Value, which has held and has even gained in value in it's MANY CENTURY history.

The 1, 2.5 and 5 gram Karatbars (999.9% Gold Bullion) provide an affordable alternative that anyone can exchange their value depreciating "papers dollars" for, to stop the fleecing, the theft and the "under the radar" transference of wealth that's been taking place due to "Inflation Tax" for more than 75 years.

What's better is that you can create a Karatbars Gold Account for FREE and stop the fleecing that's taking place.

Now you can continue on with the "Money Education" or if you're ready, learn more about Karatbars International, create your FREE Karatbars Gold Account and break the chains of slavery and bondage once and for all...starting right now.

The CHOICE is yours.

I'm Finished With The Devaluing of Our Currency

Take Me To The Dumbing Down of America and MANY Other Parts of the World

Take Me To

The Abundance and Happiness Homepage

Site Map

The products contained within the Devaluing of Currency article and throughout Abundance-and-Happiness.com have been personally tested and approved by the founder as a credible and effective means of accomplishing it's intended purpose. Any and all guarantees provided are handled through the company that provides the resource.

Copyright © 2005-2014, The Devaluing of Currency article and all content on Abundance-and-Happiness.com is strictly prohibited from copy or reproduction in whole or in part, electronically or otherwise without the express written consent of the author Chuck Danes and/or Enlightened Journey Enterprises. All Rights Reserved Worldwide

Below is EVERYTHING You'll Need to Put You Light Years Ahead of Most and Get You Headed in the Desired Direction...

|